Earlier this week, I signed onto a letter calling on Members of Congress to pair tax cuts with repeal of Inflation Reduction Act green subsidies. Here’s the full text of the Americans for Tax Reform letter:

Dear Members of Congress,

We, the undersigned organizations, are writing in support of repealing the Inflation Reduction Act’s (IRA)green new deal subsidies to pay for tax cuts in reconciliation.

As the cost of the IRA’s market-distorting energy subsidies accelerate, Congress can put an end to bad policy while delivering tax cuts to all Americans.

Failure from Congress to pass tax cuts would result in the expiration of several of the Tax Cuts and Jobs Act’s (TCJA) provisions – the largest tax increase in American history: the standard deduction (claimed by 90 percent of Americans) would be halved, a family of four earning $80,610 would see a $1,695 tax hike, and more than 26 million small business would be hit with a 43.4 percent tax rate.

Lawmakers, in compliance with the Byrd rule, are in the process of finding ways to “pay for” extending the TCJA’s tax cuts and President Trump’s other, important initiatives. We assert that tax hikes are not the answer. After all, roughly 70 percent of the corporate tax, for example, is borne by workers through lower pay and less jobs while roughly 30 percent of the tax falls on consumers through higher prices.

Rather than entertaining anti-growth tax hikes on businesses,Biden’s disastrous green energy subsidies could pay for a significant portion of President Trump’s agenda and their repeal would restore a freer market in the U.S. energy sector, ensuring more affordability, reliability, and innovation.

The cost of the IRA’s Green New Deal subsidies has become unsustainable. The IRA created or expanded several energy subsidy provisions: four clean vehicle credits, residential clean energy credit, energy efficient home credit, clean hydrogen production credit, clean electricity production tax credit, advanced energy project credit, etc.

When passed, the Congressional Budget Office (CBO) and Joint Committee on Taxation (JCT) estimated that energy-related IRA subsidies would cost about $370 billion over a ten year window. Just two years later, the CBO itself puts the cost at over double its original estimate – $786 billion.

Worse, in April 2023, the Penn Wharton Budget Model, which initially estimated $384.9 billion over ten years, updated their estimate to $1.05 trillion over ten years for just the climate and energy provisions.

As of November 2024, the U.S. Department of the Treasury expenditures report now estimates that the IRA green credits will cost $1.16 trillion from 2025 to 2034.

Most recently, in March 2025, the Cato Institute released a policy analysis finding the upper bound cost of the IRA green credits to be $1.97 trillion over ten years.

Because repealing a credit doesn’t necessarily raise what the credit costs, the Tax Foundation estimates that repealing the green new deal credits would raise $851 billion over the 2025 to 2034 budget window.

The IRA’s green new deal subsidies are bad policy. Green energy credits distort the market, threatening affordability, reliability, and innovation. They also overwhelmingly benefit the wealthy in blue states.

The massive subsidies for “clean” energy cause producers to create more electric supply than there is demand during certain hours of the day – that artificially drives down the price of energy at those times undercutting the ability of reliable baseload and dispatchable generators to recoup costs. This distortion causes consistent and affordable energy generation producers to charge more and, increasingly, shut down altogether. In the long run, we are left with less available reliable power, as we saw in Spain and Portugal this week, which ultimately means higher prices for less reliable forms of energy.

The subsidization of these existing technologies discourages people from exploring new, innovative forms of energy generation, as producing “clean” energy is already so artificially lucrative. Such a heavy, one-sided incentive structure ultimately handicaps innovation.

Additionally, data from JCT reveals EV subsidies overwhelmingly benefit the rich. Surely, these tax savings would be better spent ensuring low rates for Americans in all income brackets.

More than 83 percent of current EV credits claimed go to tax filers with an annual income of $100,000 or more. Taxpayers with an annual income exceeding $1 million account for 8 percent of all credits claimed. This should come as no surprise given the sticker price of a new electric vehicle typically ranges from $40,000 – $80,000. Subsidizing luxury cars is targeted welfare for the wealthy.

Furthermore, EV subsidies primarily benefit Democrat-run states. Eight of the top ten states for EV sales are states represented by two Democrat Senators. Of the 250,000 all-electric vehicles sold in the U.S. in 2020, according to data from the Alliance for Automotive Innovation, Californians alone accounted for over 93,000 EVs purchases. For comparison, West Virginia had only 195 EVs registered in 2020.

The IRA’s green new deal subsidies are bad policy and are costing Americans exponentially more each day. In this way, their repeal would be ideal as both a way to bring parity to the U.S. energy sector and to pay for tax cuts for all Americans.

One of the cost estimates featured comes from The CATO Institute’s March 2025 report on The Budgetary Cost of the Inflation Reduction Act’s Energy Subsidies. The paper warns leaving IRA subsidies in place could balloon to $4.7 trillion by 2050.

Joshua Loucks, one of the paper’s co-authors, joined District of Conservation to discuss his study and analyze the language being floated for the Trump-endorsed “One Big Beautiful Bill.”

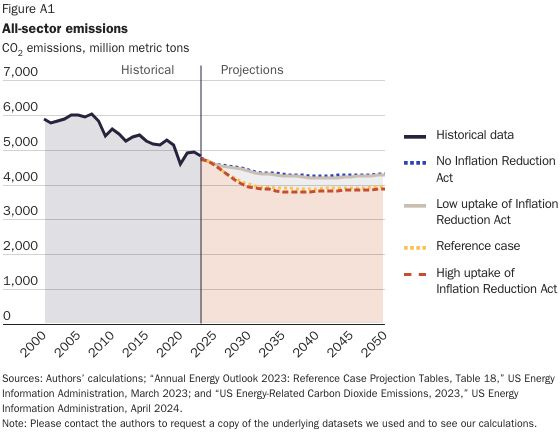

Not only would keeping the IRA be costly, it has no impact on emissions or the environment. SHOCKER. Per the CATO report: “As shown in Figure A1, the EIA’s reference case projects that all-sector CO2 emissions in the United States will decrease by 0.7 percent annually through 2050. In comparison, in the absence of the IRA, emissions would decline by 0.4 percent annually.”

Joshua broke down the report and previewed the forthcoming reconciliation battle on the podcast. Give it a listen and share please!

Great article.

A series of wildfires can cancel out any purported CO2 reduction as well 😡🤦

Nicely done, ma’am. Thank you!

I am struck by your conclusion: “Not only would keeping the IRA be costly, it has no impact on emissions or the environment. SHOCKER. Per the CATO report: “As shown in Figure A1, the EIA’s reference case projects that all-sector CO2 emissions in the United States will decrease by 0.7 percent annually through 2050. In comparison, in the absence of the IRA, emissions would decline by 0.4 percent annually.”

Here is my conundrum. CATO is considered by some to be a biased source. While I don’t necessarily disagree with their results, are you aware of any peer-reviewed studies conducted independently that confirm CATO’s results? I’ve seen some stuff by B. Lonborg that would agree, but nothing in the literature. Can you employ the resources available to you through IWF or others to do a rigorous literature search?

Assuming that in fact CATO’s results are correct, the other half of my conundrum is straightforward: if the program produces negative results, that is, an increase in emissions, why was it pursued in the first place? Did the Biden Administration, the EPA, or other responsible federal agency ask the question, “gosh, will this work and what effect will it have?” This seems to be such a fundamental question that it beggars the imagination to believe it wasn’t asked!

Thank you very much for your great work ma’am. Please keep the hits coming!